How to get the most from your UCount Rewards

Turn your everyday spending into exciting rewards with UCount Rewards, which lets you earn Rewards Points on daily transactions by simply using your Standard Bank Credit, Evolve, Cheque or Debit Card for purchases.

Your Rewards Points can be redeemed for a variety of benefits, from travel and groceries to topping up your fuel and airtime. Let’s take a closer look at the ins and outs of your UCount Rewards, from increasing how much you earn to your redemption options, so you can maximise your benefits and get the most out of UCount Rewards.

|

MORE REWARDS, MORE FUN Did you know that as a Standard Bank UCount Rewards member, using your Credit or Evolve Card could earn you from 3* times more Rewards Points with every transaction? |

More ways to maximise your UCount Rewards

Understanding a few key strategies can help you earn Rewards Points faster and unlock a world of incredible benefits. Let's dive into simple yet powerful ways to maximise your Rewards Points and get the most out of every purchase and payment.

|

Driving your Rewards Points |

Earn up to R10* back in Rewards Points per litre of fuel and oil at participating Caltex and Astron Energy service stations. You also earn Rewards Points when you shop at FreshStop. |

|

Swipe or tap and earn |

Earn up to 1%* back in Rewards Points on all card purchases, depending on your Tier Level. |

|

Treat yourself more |

Earn up to 20%* back in Rewards Points when shopping at any of our Rewards Retailers. |

|

Get the rewards you want |

Earn up to 20%* back in Rewards Points on Grocery Rewards, Fashion Rewards or Lifestyle Rewards when you select your Choose Your Own Rewards category. |

|

Stay connected |

Earn up to 2GB back in data from Standard Bank Mobile. |

|

Gains & Goals: How to make it work for you

|

Tier up for more Rewards Points

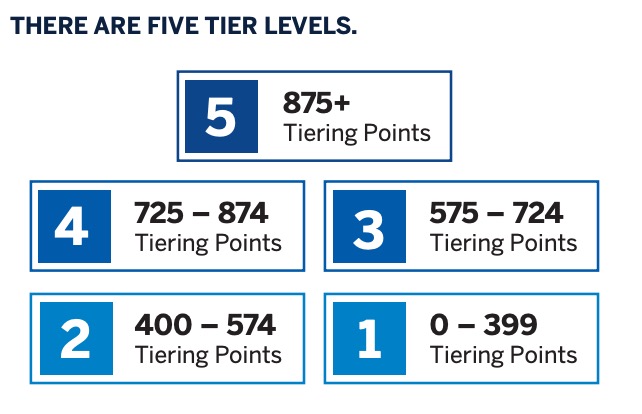

Your Tier Level, calculated by how much you engage with our products and services, determines just how rewarding your UCount Rewards experience becomes.

The more you bank with us, the higher your Tier Level, unlocking a cascade of benefits:

- Faster rewards: Watch your Rewards Points grow faster with each Tier Level upgrade.

- Exclusive benefits: Enjoy access to exclusive discounts, tailored offers and premium rewards.

Want to know your Tier Level? Identify the banking products and services you currently and could possibly use to help you get to the next Tier Level. Simply use our Tier Estimator via your logged in profile on the UCount Rewards website.

Redeeming your Rewards Points

Earning your Rewards Points is just half the fun. Once you’ve accumulated your Rewards Points, you can redeem them to get the rewards you want, when you want them:

- Fill up with fuel and oil at participating Caltex and Astron Energy service stations or grab something to eat at FreshStop.

- Shop for thousands of great deals in store and/or online at our Rewards Retailers.

- Save when you invest into an AutoShare Invest, PureSave, Notice Deposit or Tax-free Investment Account.

- See the world with amazing local and international travel deals at the UCount Rewards Travel Mall.

- Travel in style with access to Bidvest Premier Lounges at South African airports.

- Shop a range of electronic vouchers on the UCount Rewards Online Redemption Portal.

- Fund a student on Feenix™, our crowd-funding platform.

- Use your Rewards Points as a payment method for parking with the Admyt app and enjoy ticketless parking that offers great convenience.

- Use your Rewards Points to reduce your revolving loan or term loan balance.

- Pay school and varsity fees or donate to a school or university of your choice via School-Days® or Varsity-Days®.

- Donate your Rewards Points to the Gift of the Givers Foundation and help communities in need.

- Pay for your rental of your safe deposit vault with IBV International Vaults or make gold and silver bullion purchases with IBV Gold through IBVGold.com or at any of the seven South African branches.

Not a UCount Rewards member yet?

Join UCount Rewards today and start your rewards journey with us.

*Terms and conditions apply.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.