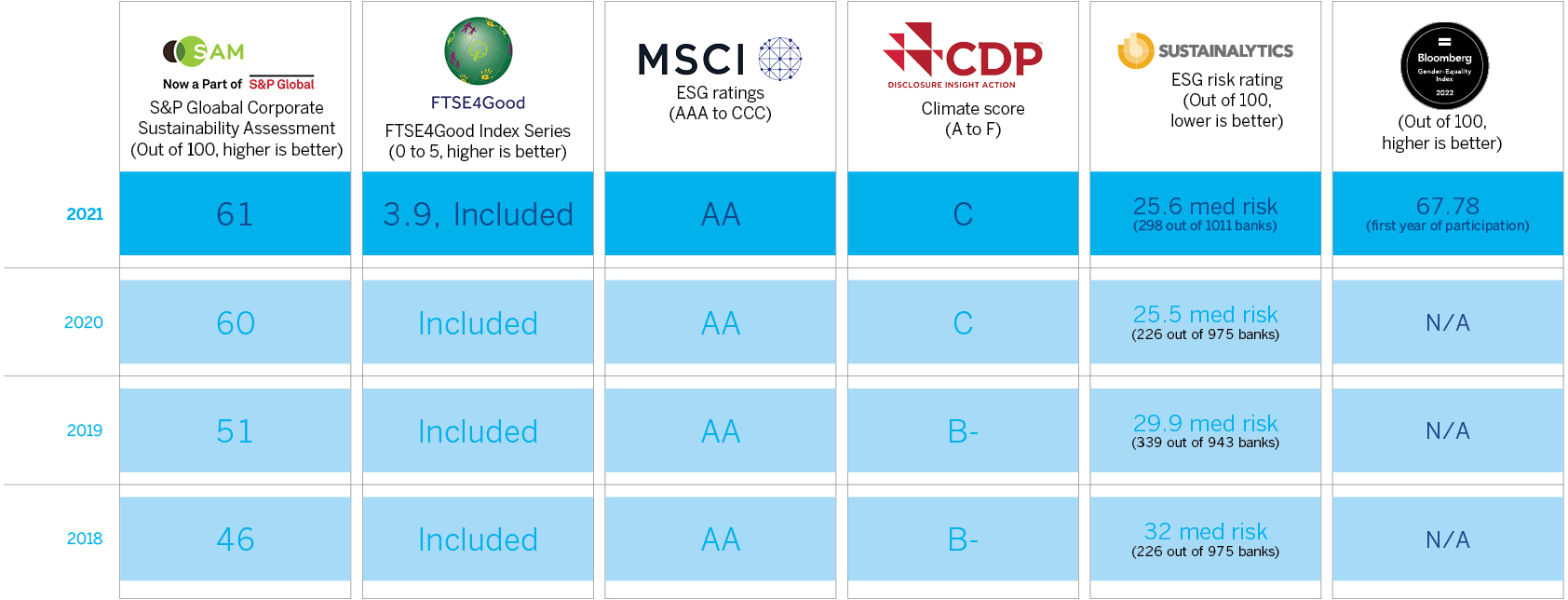

Managing environmental, social and governance risks

Standard Bank Group strives to increase the positive SEE impacts arising from our business activities and reduce negative impacts. We do this by managing environmental, social and governance risks and embedding a culture of responsible banking across the group.