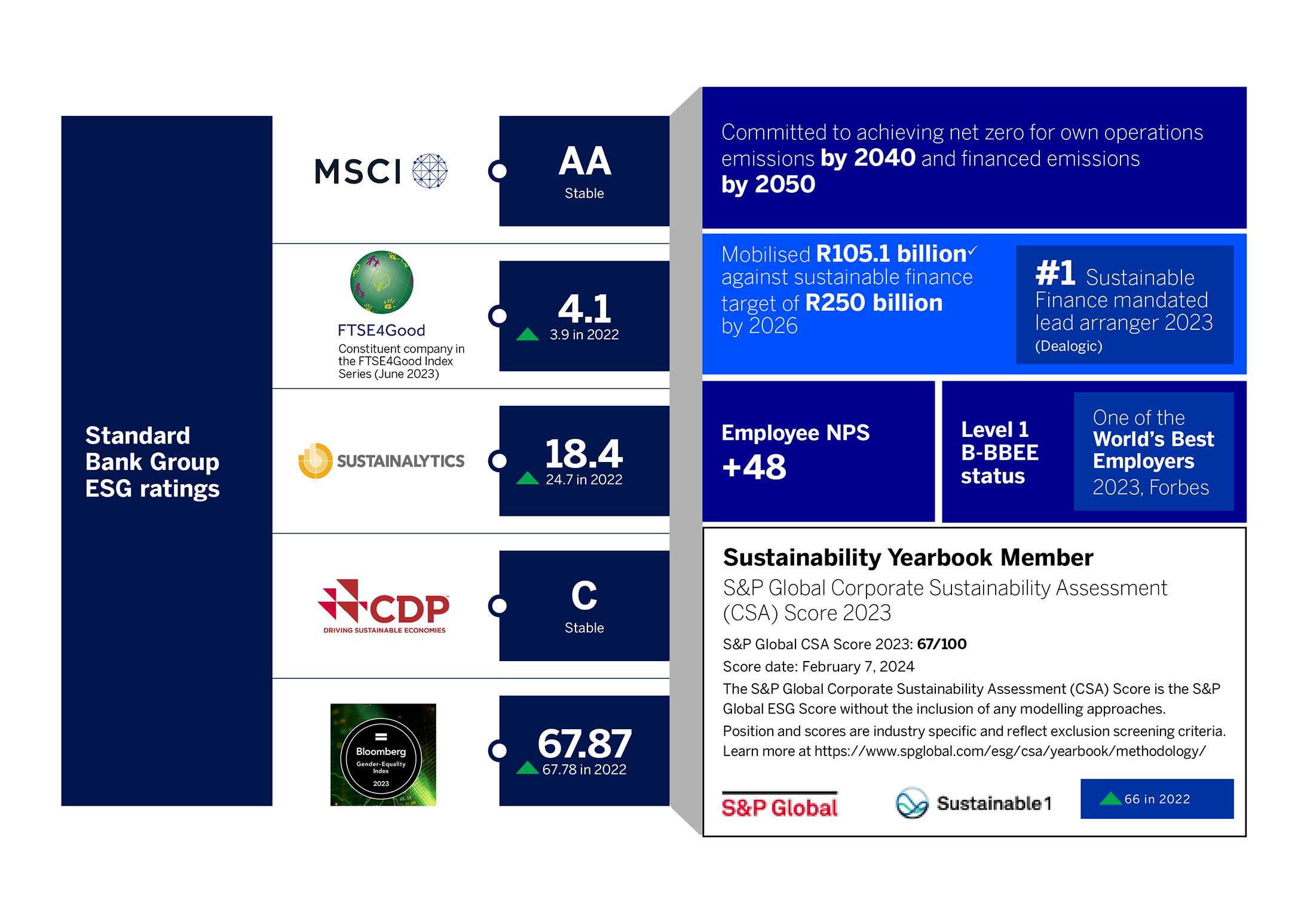

Environmental, social and governance risks and opportunities

We are committed to ensuring that our strategy is consistent with our mission of driving sustainable growth in Africa and contributes to society’s needs and priorities as expressed by the UN sustainable development goals (SDG), the Paris Agreement, the AU’s Agenda 2063 and sustainable banking frameworks in our countries of operation.

Our efforts to achieve positive impact are underpinned by careful identification, management and mitigation of environmental, social and governance (ESG) risks. This includes risks within our own operations and risks arising from our business activities, including our client relationships and the projects and businesses we finance or invest in. ESG risk management is embedded in our policies, processes, and governance structures. We engage our diverse stakeholders to identify and manage our material ESG issues.

Credentials and Milestones

Committed to achieving net zero for own operations emissions

Committed to achieving net zero for financed emissions

Mobilised

against sustainable target of 250 billion rand by 2026

Dealogic

2023

Forbes

2023

Employee NPS