Protect your capital with this foreign exchange hack

Retaining the buying power of one’s capital is a constant challenge at the best of times, and even more so in an inflationary environment. Spare a thought for international banking clients who face the added hurdle of a weak or volatile currency.

A currency that constantly devalues against major currencies like the US dollar, pound sterling or euro suffers even greater loss of buying power and ultimately, long-term wealth.

Irrespective of whether you need foreign currency for travelling, working or doing business abroad, there’s a strong case to be made for opening an international bank account. This provides you with a transactional bank account in a major currency that you can use to bank offshore as easily as you do at home.

Opening an international bank account could allow for long-term wealth preservation for individuals with the means and the desire to do so. It’s an avenue open to anyone who meets the qualifying criteria, with applications and documents now processed digitally for greater ease and convenience.

At Standard Bank you will also be assigned a personal banker who is on call to answer queries, process applications and help to simplify your international banking experience.

Use an offshore account to diversify

As we illustrate in the examples below, simply moving capital into an international bank account can assist in countering the effects of a weakening currency.

By not moving some capital into hard currency, you may lose buying power. This loss of value is partly due to inflation, but also due to your currency’s diminished buying power in relation to major currencies.

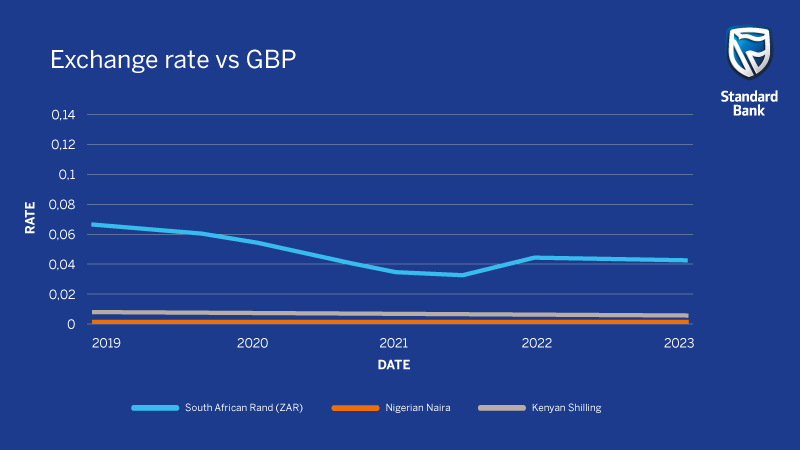

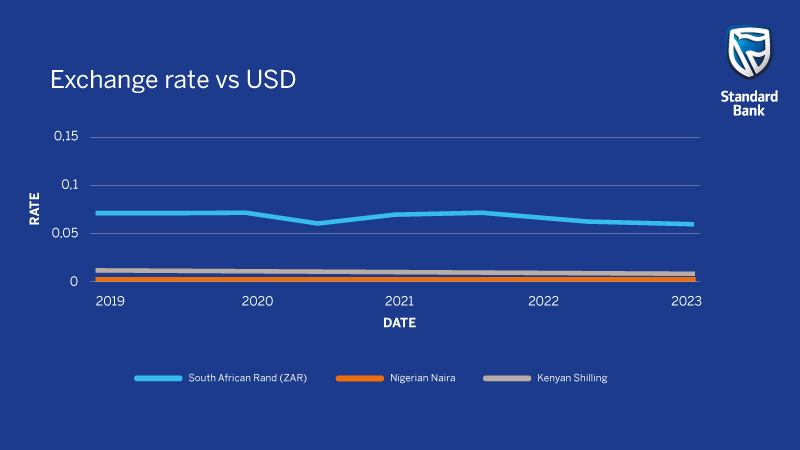

Take a look at the following graphs that show how the currencies of seven African nations fared against pound sterling and the US dollar between 2019 and the beginning of 2023. Without exception, citizens of these countries were poorer off in double-digit percentages against the pound sterling, and nearly all poorer off against the US dollar.

The exchange rates shown are the publicly traded spot prices for each currency on each date.

The best-performing currency against pound sterling was the Kenyan Shilling, which lost -11.84% of its value over this period. Four others lost between 14% and 15% of their value, while the Zambian kwacha fell more than 35% and the Ghanaian cedi plummeted nearly 50%.

The graphs show how these devaluations count in your favour, even if you earned no interest on your capital and merely converted it back to your original currency.

Optimise your offshore capital

These figures help to illustrate the case for holding some of your capital offshore in an international bank account. The healthy returns are compelling, even if you earned no interest on your deposit.

Standard Bank provides various deposit options including quick access savings accounts,https://international.standardbank.com/international/personal/products-and-services/grow/savings-accounts money market accounts and notice and fixed-term savings accounts. More complex options include longer term instruments like structured products or investment funds.

How you choose to use your offshore deposits will depend on your circumstances and goals. If your goal is to preserve your capital, then limiting the possibility of losses through ill-advised decisions is imperative. It is always advisable to speak to your Standard Bank Group relationship manager or IFA to find the right solution for your specific needs.

Please note that the information set out above is for your general information only and is not intended to constitute or be relied on as financial advice, investment advice, trading advice or any other advice or recommendation. Appropriate independent advice should always be obtained from a financial professional before making any investment decisions.